3 Option Hedge Strategies to Protect Your Portfolio

Worried about a pullback? These options strategies offer short-term protection and peace of mind.

Modern Portfolio Theory teaches us that long-term returns are driven primarily by asset allocation - the mix between risky and risk-free assets. But while that's great for long horizons, it won't help you sleep at night during a sudden volatility spike.

For that, you need tactical tools. Option hedging strategies offer short-term defense against drawdowns, sector-specific risks, or market-wide volatility.

As of 2025, the S&P 500 (SPY) is trading above 510, and volatility remains low by historical standards. But that won't last forever. Consider these strategies if you're concerned about elevated valuations or want to hedge a specific portfolio risk.

✅ 1. The Long Put Spread

Best for: Simple, defined-risk downside hedge

Risk level: Moderate

Capital needed: Low

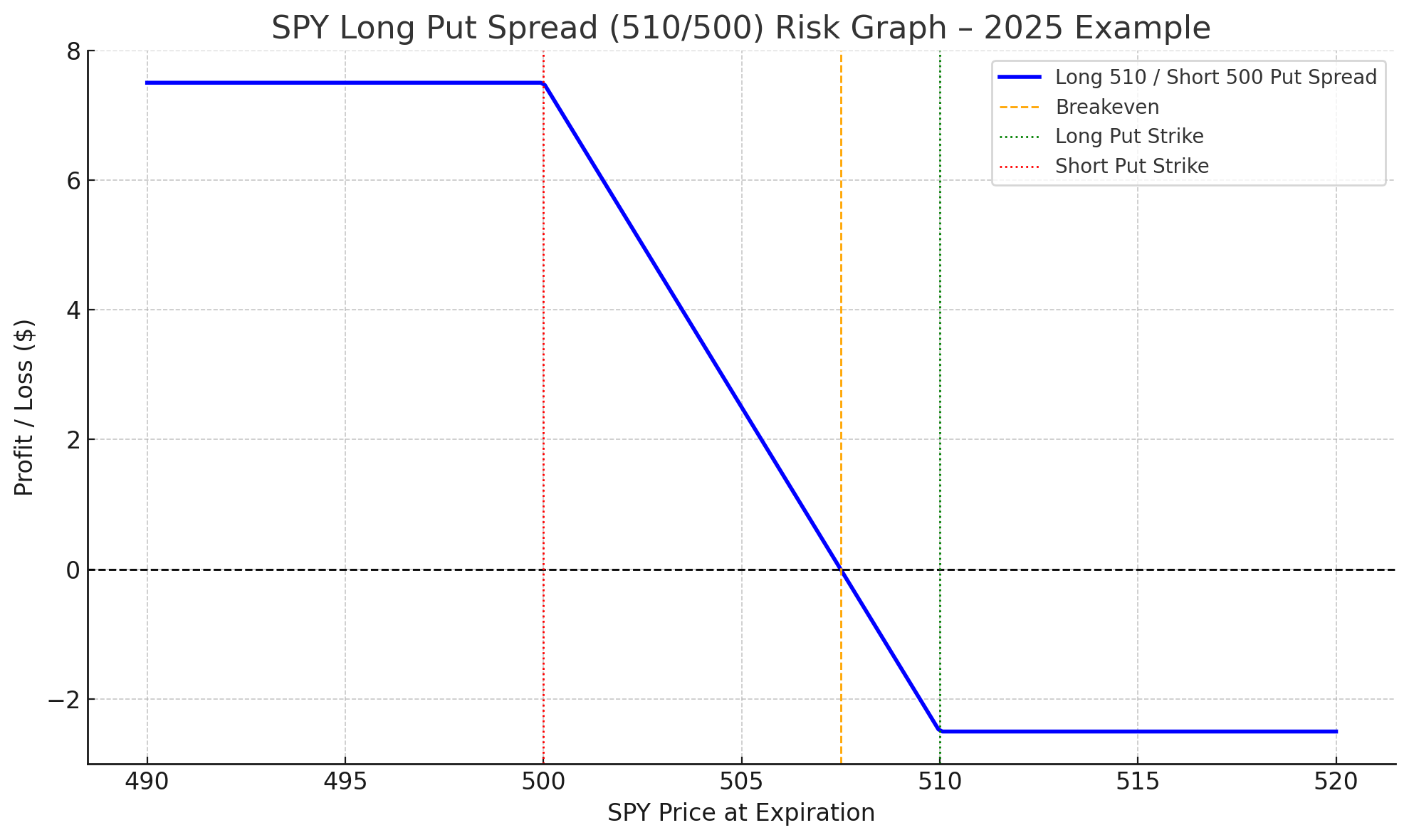

A long put spread is a debit spread designed to profit when the underlying asset declines. You buy a higher strike put and sell a lower one, creating a defined risk and a defined reward setup.

Example:

SPY is currently at $512.

- Buy the $510 put (cost: ~$6.00)

- Sell the $500 put (credit: ~$3.50)

- Net debit: $2.50

- Max gain: $7.50

- Max risk: $2.50

- Breakeven: $507.50

This setup gives you protection if the market drops moderately. Selling the lower strike put reduces your upfront cost compared to buying a single put outright.

❌ 2. The Short Call Spread

Best for: Traders looking to collect premium while staying bearish

Risk level: Moderate

Capital needed: Margin required

A short call spread can serve a similar purpose - profiting from a market decline or stagnation - but uses calls instead of puts.

Using SPY again:

- Sell the $515 call (receive ~$4.00)

- Buy the $525 call (pay ~$1.50)

- Net credit: $2.50

- Max risk: $7.50

- Breakeven: $517.50

The benefit here? You're collecting premium up front because you are selling options. The downside? This is a margin trade and exposes you to higher capital requirements and potential margin calls if things move against you.

📈 Index Options You Can Use to Hedge

While we've used SPY in the examples above, here are other index ETFs commonly used for hedging:

- QQQ – NASDAQ 100 (suitable for tech-heavy portfolios)

- IWM – Russell 2000 (small-cap exposure)

- DIA – Dow Jones Industrials (blue-chip stocks)

💡 Tip: Match your hedge to your portfolio exposure. If you're overweight tech, a put spread on QQQ might be more effective than SPY.

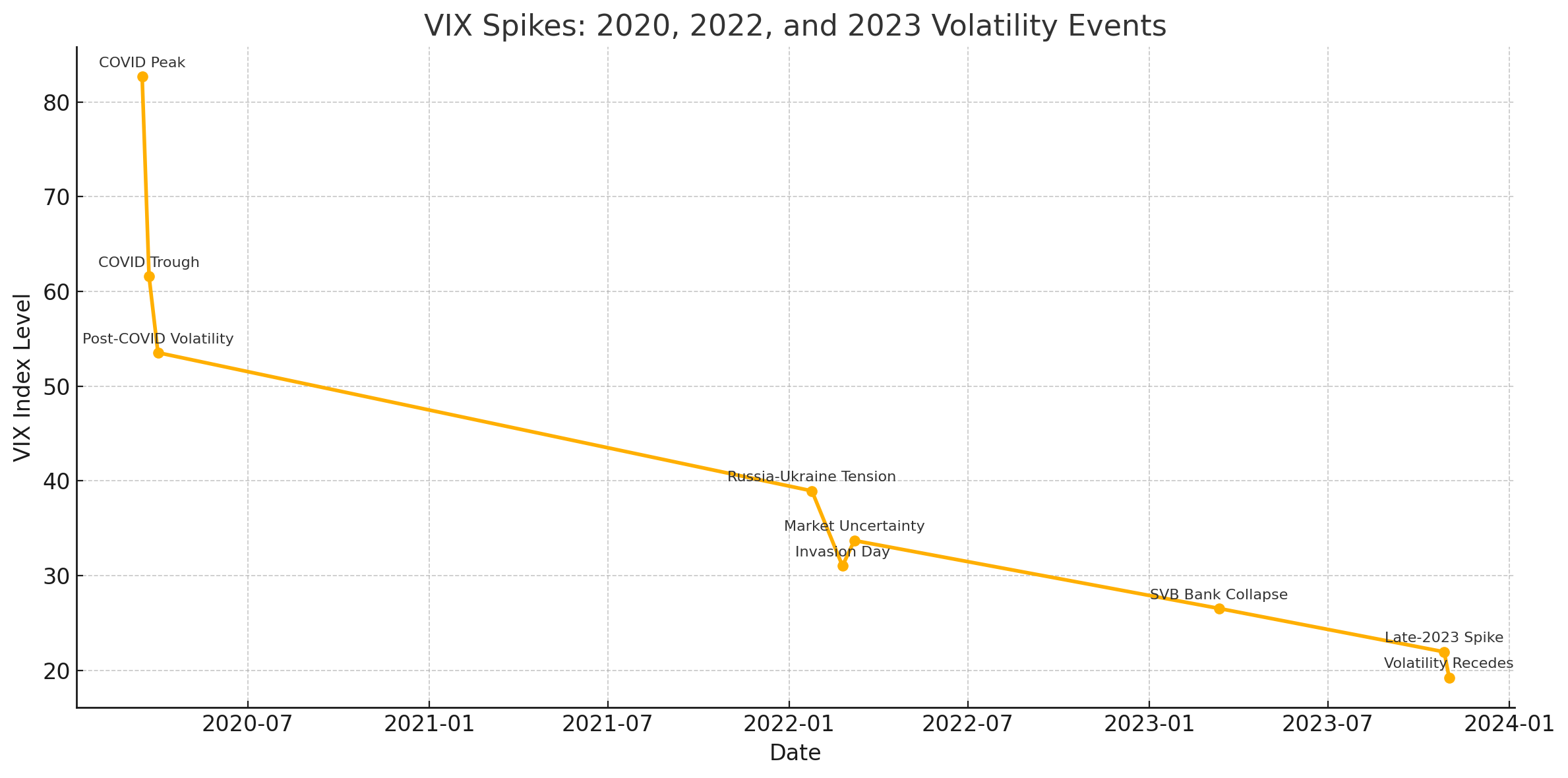

🌪️ Want to Hedge Volatility Itself?

Options on the VIX Index allow you to hedge against a spike in volatility directly. You can:

- Buy VIX calls

- Use a VIX call spread

- Sell VIX put spreads

As volatility rises during market drops, long exposure to VIX options can act as an effective portfolio hedge.

🧠 Advanced Hedging Strategies

If you're more experienced with options, you might consider these advanced techniques:

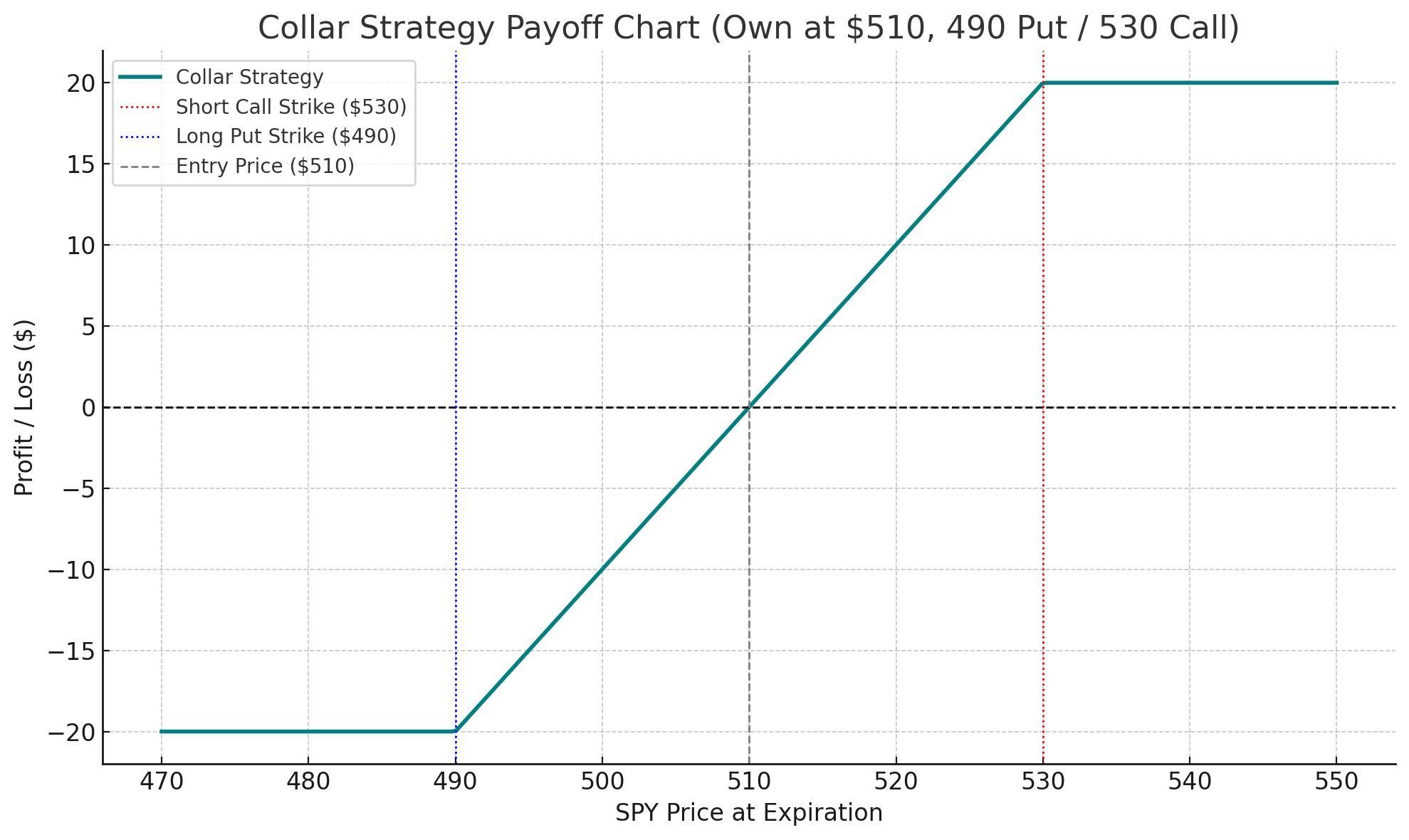

🛡️ The Collar

A collar is a defined-risk strategy best suited for investors who already own the underlying asset. It involves:

- Selling an out-of-the-money call

- Buying an out-of-the-money put

You cap both your upside and downside. But when the call premium fully funds the put, you've effectively hedged your downside for free.

Example (owning SPY at $510):

- Sell $530 call

- Buy $490 put

- Net cost ≈ $0 (depending on volatility/skew)

This structure is ideal for protecting gains in a long-term holding without exiting the position.

🔁 The Risk Reversal

A risk reversal mimics owning the underlying:

- Buy a call

- Sell a put (usually the same strike or slightly lower)

It behaves similarly to going long the asset - with lower capital outlay - but comes with the obligation to buy the underlying if it falls below the short put strike.

This strategy is useful when you're bullish on volatility or want leveraged upside exposure with risk.

🧩 Final Thoughts

Markets don't ring a bell before correcting. The strategies above - from simple spreads to advanced collars - give you tools to prepare without panicking.

Whether you're hedging a full portfolio, a sector bet, or just one trade - now's the time to get familiar with these strategies before volatility returns.

Stay Connected!

Join our mailing list to get notified of all new blog posts, and receive the latest news and updates from our team.