Options Break-Even Prices Explained: The Intuitive Way to Understand Any Strategy

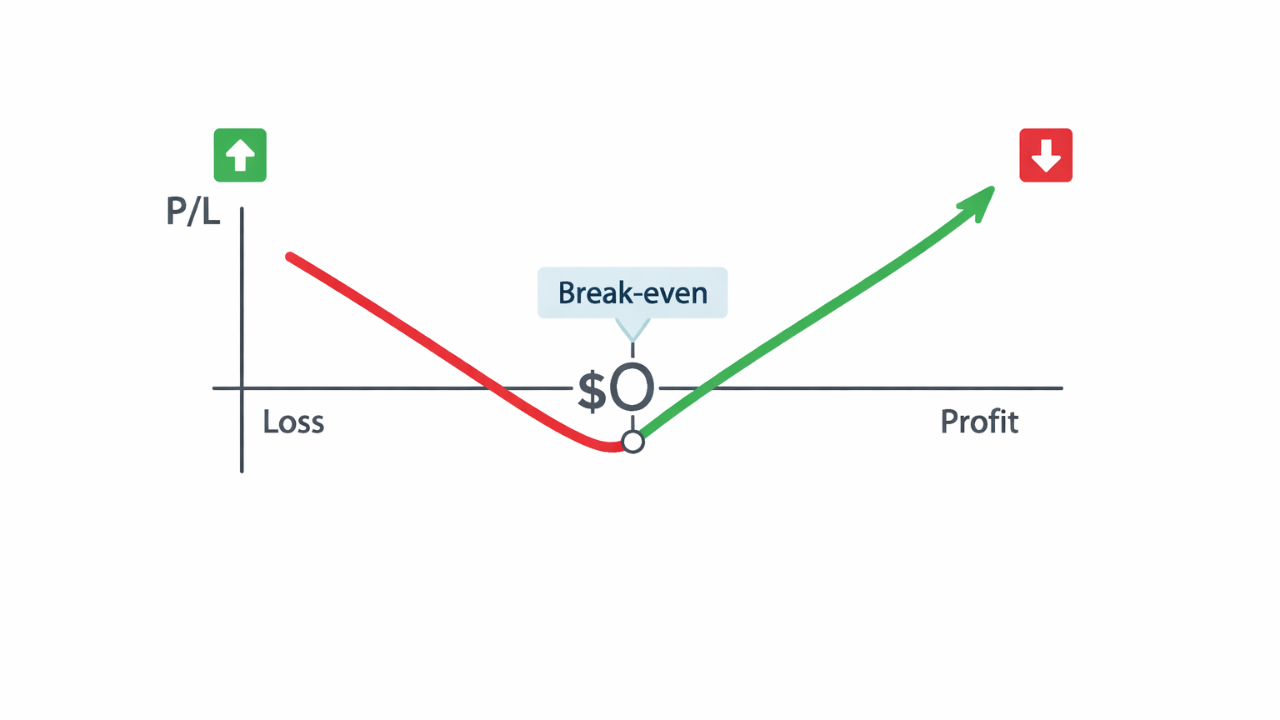

Every options strategy has a break-even price. When a position is "at break-even," your profit and loss is zero at expiration. That sounds simple, but many traders get stuck memorizing formulas instead of understanding why those formulas work.

This guide teaches break-evens the intuitive way, using the same core question for every strategy:

What stock price at expiration gives my position intrinsic value equal to what I paid (or equal to the credit I received)?

Once you understand that, break-evens stop feeling like math tricks and start feeling logical.

First, Why Break-Even Only Truly Matters at Expiration

Break-even prices are most meaningful at expiration, when extrinsic value (time value) has decayed away and options trade mostly on intrinsic value.

Before expiration, your position can be profitable even if the stock is below your "break-even," because:

⚡ implied volatility can rise,

⚡ time value can remain,

⚡ the position might have favorable Greeks (like delta/gamma),

⚡ you may be able to sell the option(s) for more than intrinsic value.

So treat break-evens as an expiration reference point, not a rule for what must happen tomorrow.

The One Rule That Works for Every Options Strategy

To find a break-even price, ask:

At what stock price will this position have net intrinsic value equal to my entry price?

➕ If you paid a debit: break-even occurs when net intrinsic value equals that debit.

➕ If you received a credit: break-even occurs when net intrinsic value equals the credit (meaning your position's intrinsic loss equals the credit received, bringing P/L to zero).

"Net intrinsic value" is simply:

Intrinsic value of options you own minus

Intrinsic value of options you are short

At expiration, that net intrinsic value is essentially what the position is worth.

Break-Even for a Call Option

Whether you buy a call or sell a call, the break-even stock price at expiration is the same:

Call break-even = strike price + option price

Example

- Call strike: 250

- Price paid/received: 12.37

Break-even = 250 + 12.37 = 262.37

Why it makes sense:

- At expiration, a 250 call is worth (stock price - 250) if it's in the money.

- If the stock is 262.37, intrinsic value is 12.37.

- If you paid 12.37 and the option is worth 12.37, P/L is zero.

Break-Even for a Put Option

Put break-even = strike price - option price

Example

- Put strike: 175

- Price paid/received: 7.50

Break-even = 175 - 7.50 = 167.50

Why it makes sense:

- At expiration, a 175 put is worth (175 - stock price) if it's in the money.

- If the stock is 167.50, intrinsic value is 7.50.

- If you paid 7.50 and it's worth 7.50, P/L is zero.

Break-Even for a Call Vertical Spread

A call vertical spread is:

- Long a call at a lower strike

- Short a call at a higher strike

This position has value at expiration based on how far the stock is above the long strike (until it caps out at the short strike).

The intuitive question:

At what stock price will the spread's intrinsic value equal what I paid?

Example: 250/260 call spread (debit spread)

- Buy 250 call

- Sell 260 call

- Net cost: 3.35

Break-even = long strike + debit

Break-even = 250 + 3.35 = 253.35

Why it makes sense:

- At 253.35, the 250 call has 3.35 of intrinsic value.

- The 260 call has 0 intrinsic value.

- Net intrinsic value = 3.35, which matches what you paid.

Break-Even for an Iron Condor

A short iron condor is typically:

- Sell a put spread (OTM)

- Sell a call spread (OTM)

- Collect a credit

Because it's a range trade, it has two break-even points.

Example

- Short 110/100 put spread

- Short 130/140 call spread

- Credit collected: 2.50

Lower break-even = short put strike - credit

Lower BE = 110 - 2.50 = 107.50

Upper break-even = short call strike + credit

Upper BE = 130 + 2.50 = 132.50

Why it makes sense:

- If the stock finishes at 107.50, the 110 put has 2.50 intrinsic value, and everything else expires worthless.

- That 2.50 intrinsic loss offsets your 2.50 credit, so P/L is zero.

- Same logic on the upside at 132.50 with the 130 call.

Break-Even for a Butterfly Spread

Butterflies are where traders often get confused, because you must think in net intrinsic value across multiple legs.

A call butterfly is:

✅ Buy 1 lower-strike call

✅ Sell 2 middle-strike calls

✅ Buy 1 higher-strike call

Example: 125/135/145 call butterfly

- Buy 125 call (x1)

- Sell 135 calls (x2)

- Buy 145 call (x1)

- Debit paid: 4.50

A butterfly has two break-evens.

Lower break-even (easy)

Lower BE = lower strike + debit

Lower BE = 125 + 4.50 = 129.50

Why it makes sense:

- At 129.50, the 125 call has 4.50 intrinsic.

- The 135s and 145 are still worthless.

- Net intrinsic value = 4.50, matching the debit.

Upper break-even (less obvious)

Upper BE = higher strike - debit

Upper BE = 145 - 4.50 = 140.50

Why it makes sense using net intrinsic value:

At a stock price of 140.50 at expiration:

- 125 call intrinsic: 140.50 - 125 = 15.50 (you own this)

- 135 call intrinsic: 140.50 - 135 = 5.50 each, and you're short two = 11.00 (you owe this)

- 145 call intrinsic: 0 (worthless)

Net intrinsic value = 15.50 - 11.00 = 4.50

That equals what you paid, so P/L is zero.

This "net intrinsic value" idea is the key to understanding break-evens on multi-leg strategies.

The Big Takeaway

You don't need to memorize break-even formulas.

You need one repeatable concept:

The break-even price of any option strategy is the stock price at expiration where the position's net intrinsic value equals your entry price.

- Single-leg trades are straightforward.

- Spreads build on the same logic.

- Condors have two break-evens because they're range positions.

- Butterflies require net intrinsic value across multiple legs, but the principle never changes.

Stay Connected!

Join our mailing list to get notified of all new blog posts, and receive the latest news and updates from our team.