Understanding Option Greeks: Delta

Delta is the most widely known of all the option Greeks and for good reason. Whether you're trading calls or puts, Delta tells you how your option reacts to price movements in the underlying stock. But there's more to Delta than just direction. In this post, we'll show you how to use Delta to assess probability, position sizing, and profit potential.

What Is Delta?

Delta measures how much the price of an option will change for every $1 move in the underlying asset.

✅ Call options have Delta values between 0 and +1

✅ Put options have Delta values between 0 and -1

✅ A Delta of 0.50 means the option will gain or lose about $0.50 for every $1 move in the stock

But Delta isn't just about price, it also reflects probability and exposure:

✅ A 0.30 Delta call has about a 30% chance of expiring in the money

✅ A 0.70 Delta option behaves like owning 70 shares of stock

Delta in Action: Apple $100 Call Example

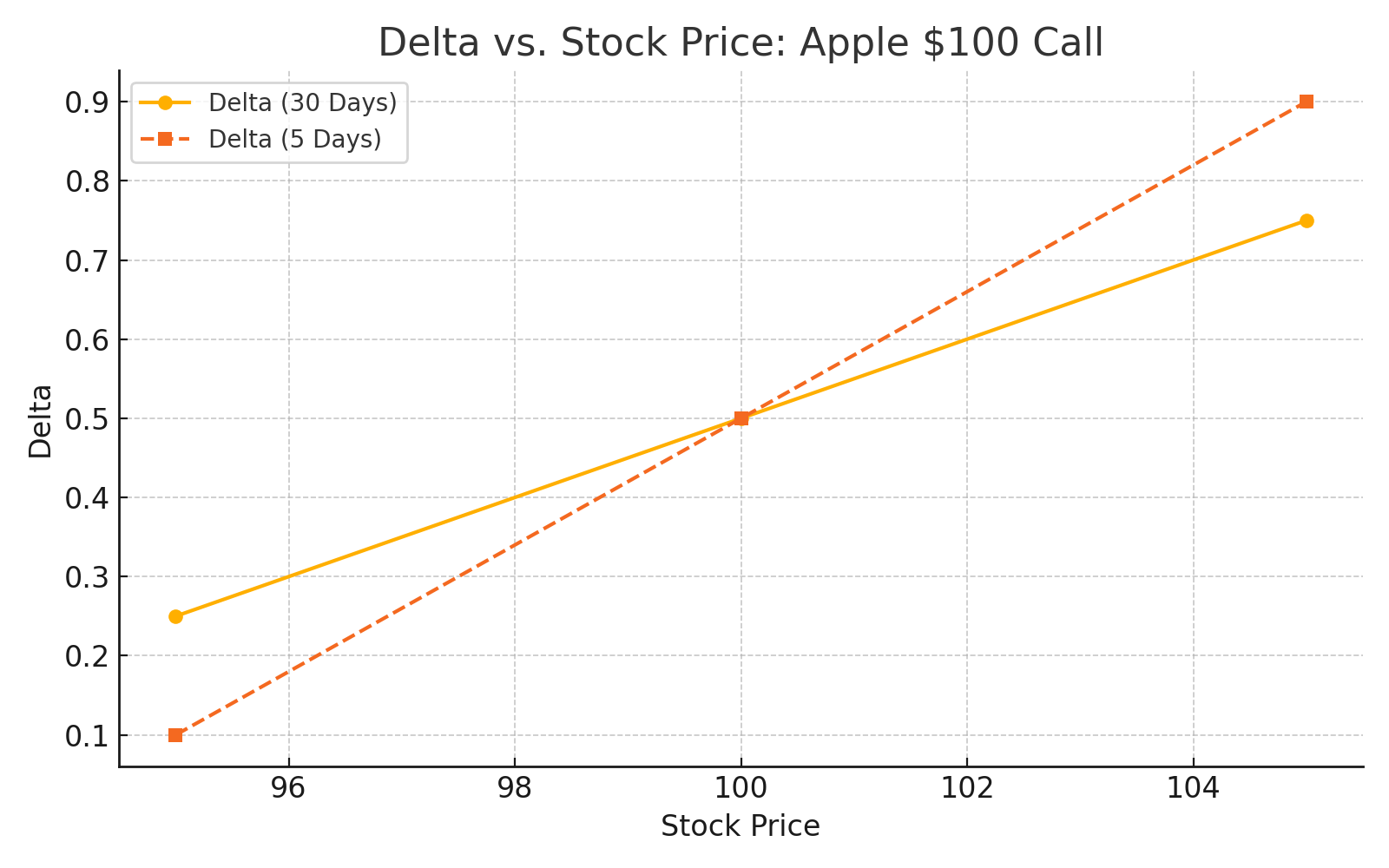

Let's analyze a $100 call on Apple (AAPL) at various stock prices and expiration dates. This shows how Delta shifts as the option moves in or out of the money, and as expiration approaches.

Delta Comparison Table

Chart: Delta vs. Stock Price

Key Takeaways

⚡ Delta tells you how much an option moves when the stock moves $1

⚡ High Delta = more stock-like behavior

⚡ Low Delta = more option-like behavior (lower cost, lower probability)

⚡ Delta also represents the probability of expiring in the money

⚡ Traders use Delta for position sizing (e.g., 5 contracts of 0.20 Delta = ~100 shares of exposure)

Real-World Implications

Let's say you're bullish on Apple and want leveraged exposure. A deep in-the-money call (Delta 0.80+) will move almost dollar-for-dollar with the stock, ideal if you expect a strong directional move.

But if you're selling options, Delta helps you understand risk zones. For example, selling a put with a 0.20 Delta gives you about an 80% probability the trade will expire worthless-but you're also accepting that 20% chance it won't.

Final Thoughts

Delta is the foundation of every options trade. It gives you insight into price sensitivity, directional risk, probability, and portfolio exposure. Whether you're buying calls, selling puts, or trading spreads, understanding Delta is essential for controlling risk and maximizing reward.

Want to learn how professional traders build Delta-neutral strategies or use Delta in hedging? Enroll in our Options Trading in 21 Days course, where we go deep into practical, real-world applications of all the Greeks, starting with Delta.

Stay Connected!

Join our mailing list to get notified of all new blog posts, and receive the latest news and updates from our team.