Understanding Option Greeks: Theta

When it comes to option trading, not all risks stem from market direction time can also work against you. That's where Theta comes in. This Greek tells you how much value an option loses each day as expiration approaches. In this article, we'll break down Theta and help you use it to your advantage.

What Is Theta?

Theta measures an option's time decay-the amount the option's price will drop each day if all other variables remain constant. It's expressed as a negative number for long options, indicating a daily loss in value.

✅ Theta = Time decay

✅ Applies more to at-the-money options

✅ Becomes more pronounced as expiration nears

Here's a simple rule of thumb: Options are wasting assets. With each passing day, they lose some of their extrinsic value (in terms of time value), and Theta measures exactly how much.

Theta in Action: The Impact of Time Decay

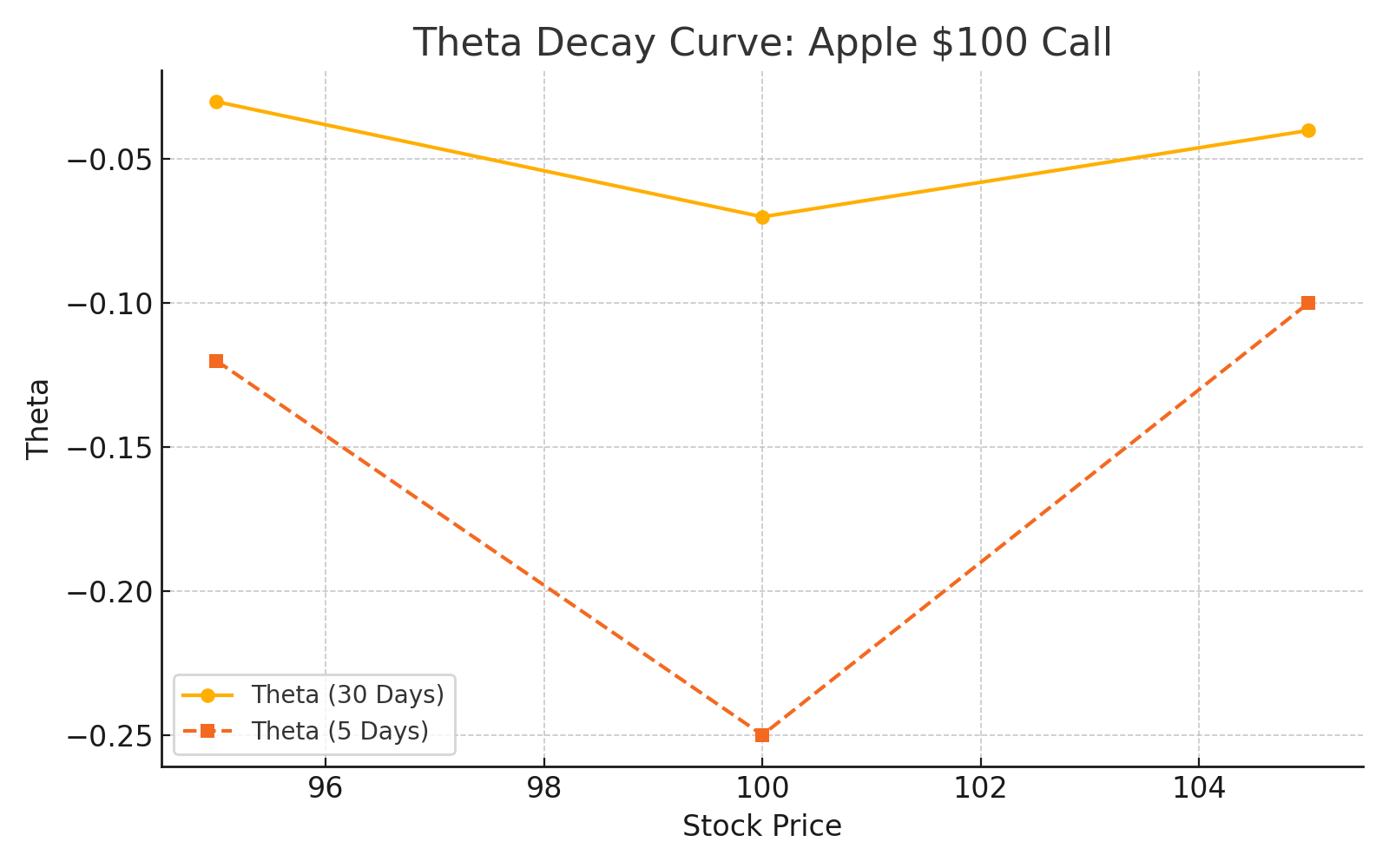

Let's look at an example using a $100 call option on Apple (AAPL). We'll compare Theta across different expiration periods-30 days versus 5 days-to illustrate how time decay accelerates as expiration approaches.

Theta Comparison Table

Chart: Theta Decay Curve

Key Takeaways

⚡ Theta is your enemy if you're buying options. The clock is always ticking.

⚡ Theta is your friend if you're selling options. Time decay works in your favor.

⚡ At-the-money options experience the most rapid time decay near expiration.

⚡ Longer-dated options decay slowly at first, then rapidly accelerate.

Real-World Implications

Say you bought a short-term call option, and the stock price stays flat. Even if you're directionally correct, longer term, your option might still lose value each day due to Theta, especially in the final week before expiration.

On the other hand, if you're an option seller (such as with credit spreads or naked puts), Theta is working in your favor. You can still profit even if the underlying stock barely moves, as long as time continues to tick and the option expires worthless.

Final Thoughts

Theta is one of the most underappreciated forces in options trading. While many traders focus solely on price direction, seasoned pros know that time decay can make or break a trade. Use Theta to manage risk, time your trades, and structure your strategies wisely.

Want to dive deeper into all the Greeks? Our course at Options Trading in 21 Days gives you real-world examples, trader-tested strategies, and chart-based lessons to help you master options from every angle.

Stay Connected!

Join our mailing list to get notified of all new blog posts, and receive the latest news and updates from our team.