How Trading Options is Like Playing Chess?

Many novice traders think that making money with options is simple. One merely needs to guess the direction in which a stock will move correctly. Get that right, and you're a winner. If you think the stock will rise, buy a call. If you believe the price will fall, buy a put. Do that, and you'll make money every time.

🧐 Ah, if only it were that simple.

That kind of naïve view of options trading is akin to thinking that chess is a simple game because it's played on a checkerboard.

The truth is that trading options are very much like playing chess. Neither endeavor is simple nor straightforward. Without a keen understanding of fundamentals, both pursuits can be frustrating. In the case of options trading, that frustration is typically accompanied by losses of real money.

Why Chess Is So Complicated

A chessboard is an alphanumerically labeled grid with numbers along the vertical axis and letters along the horizontal axis. The board doesn't display these numbers or letters, but experienced players know they exist.

It's how tournament champions diagnose other players' moves and their own mistakes after matches. The grid structure and virtual labeling allow computer software to emulate the board and develop playing algorithms. And, indeed, people do play chess on computers.

A chess match places two players, and their pieces face to face horizontally. The object of the game is to move pieces so that an opponent's King is compromised in an indefensible position. The simplest way to make that happen is to control the center of the board from beginning to end, defending a position and killing the opposing player's high-value pieces.

Easy, right? One player marches a miniature army across the board, killing the opponent's pieces until that player's King is backed into a corner. And checkmate! The game is over. The problem is that there is no way of knowing what the other player thinks and how they might react to their opponent's moves.

Both of them seek to control the center of the board. Each player has the same objective, and only one can win. Both players can sacrifice pieces on the board to gain a strategic advantage. And each of them has their eye trained on their opponent's King. But with every move, the dynamics change.

Why Options Trading Is So Complicated

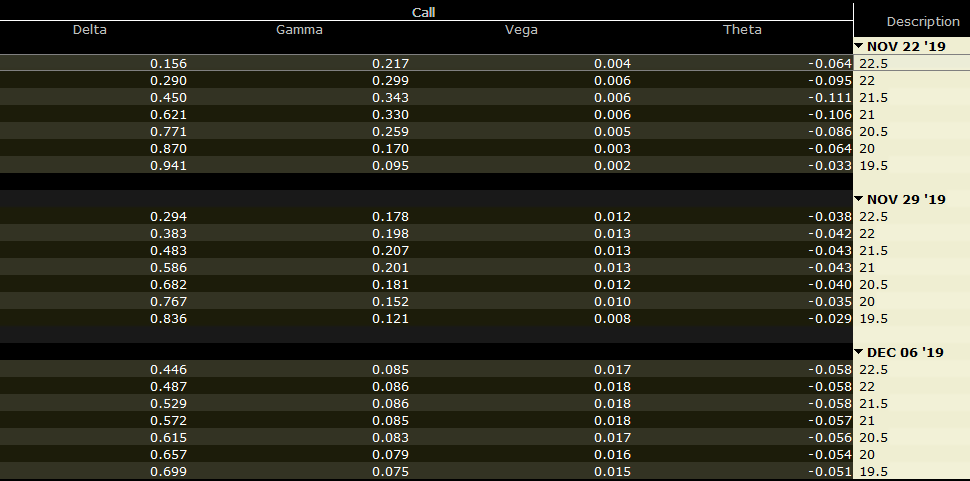

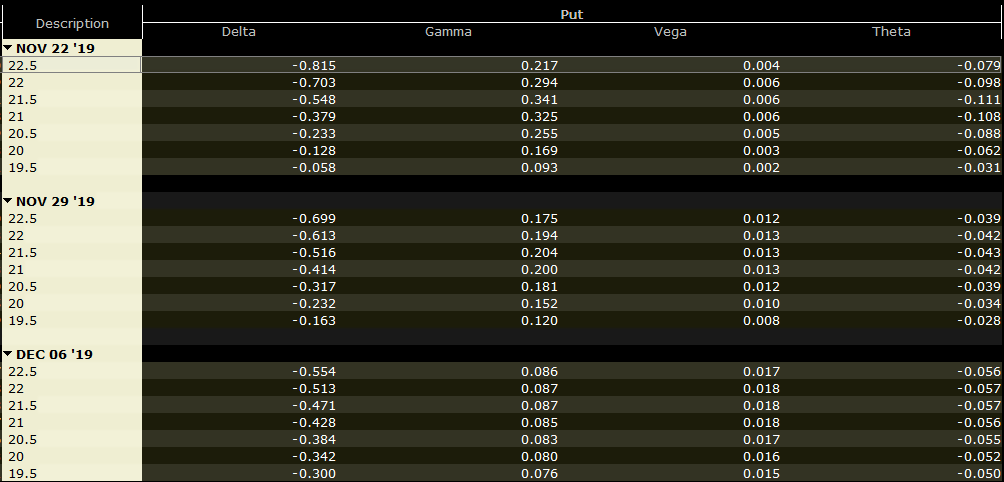

In a roundabout way, options trading is also performed on something of a grid, laid out not alphanumerically but still with important information displayed along vertical and horizontal axes. The images below display an options matrix for a given stock's calls and puts.

I've broken the matrix into two pieces to make viewing easier. Importantly (and intentionally), this matrix doesn't show option premiums or the whole option chain. It displays what experienced options traders will recognize as the "Greeks" for each options series running up and down the vertical axis.

As you can see, each Greek of each strike for each expiration has a different value. And each one of these Greeks affects all of the others. That's the case for both types of options, calls (above) and puts (below). The dynamics change with every tick of a stock's price, up or down. Every one of the Greeks changes.

In fairness, I could have shown an options matrix that displays premium, the price an options buyer will pay or a writer will receive. But the point here is to explain why options trading is so complicated. The Greeks are the reason why an options trader who correctly picks the direction of a stock's price can still lose money.

Common Elements of Success

The skills necessary to play chess are the same ones an investor needs to be successful in trading options. There are certain constants in both endeavors. These are discipline, preparation, analysis, purpose, versatility, risk management, and composure. Let's look at how each one of them relates to both playing chess and trading options.

👣 Discipline

Successful chess players have a predictable pattern of moving pieces around the board. Their opening moves are generally the same. They are consistent. They are disciplined.

Their manner of play is focused, strategic, and deliberate. This is the same for successful options traders. To be successful, they must also be consistent. They must do the same things every time, without exception.

For chess players and options traders, the worst trait is a lack of discipline.

📚 Preparation

Being disciplined also means that the steps one takes before execution are consistent. This is the case in chess and options trading.

Chess Grandmasters don't go into matches haphazardly. They prepare. Likewise, successful options traders don't enter trades without proper preparation.

The chess player must understand and prepare for an opponent. They must know what the opponent's strengths and weaknesses are. The same is true of any options setup. The trader must understand how a given trade structure will perform under different circumstances.

A long call spread will behave differently than a long calendar call spread, and the trader needs to know which one is most likely to achieve its intended outcome. Proper preparation moves the chess player and the options trader closer to their intended result.

📈 Analysis

Part of preparation means analyzing the environment. The chess player needs to consider the other players in a tournament to determine how to play each matchup in the various brackets leading up to the finals.

Likewise, the options trader needs to consider the many variables that could impact the success or failure of a particular trade setup. As the chess player needs to evaluate the competition, the options trader must consider the variables affecting a trade.

The options trader needs to know where support and resistance are, how implied volatility compares to historic volatility and the potential that some event could cause a sudden price change in the underlying stock, such as a dividend payment or earnings announcement.

📝 Purpose

The above analysis needs to be considered in the context of the specific goal of the chess player and options trader. Clearly, both want to win. This might mean moving up through each bracket and playing in the tournament's final round for the chess player.

Maybe it means achieving a personal best. Perhaps it means something else. For the options trader, it must mean closing out the trade profitably. Yet what is appropriate for one trader may not be acceptable for another.

For one, achieving a 10% return might be a reasonable goal. For another, it might be something higher than that. For the chess player and the options trader to be "successful," they must have a stated goal or purpose for what they are about to do.

🌀 Versatility

Setting goals helps frame the focus for both the chess player and the options trader. An intended purpose helps people visualize and work toward an intended singular outcome. But things don't always go as planned.

So, the chess player and the options trader must be versatile. They need to think on their feet and change course when necessary. For the chess player, this may mean looking ahead and altering planned moves to counter an unanticipated attack by an opponent.

For the options player, maybe it means closing one leg of an iron condor as a stock breaks out of an initially anticipated range. In either case, being flexible to respond to unexpected changes can help the chess player and the options trader make the best of a bad situation. This is what separates the champions from the amateurs.

⚠️ Risk Management

Being versatile, however, doesn't mean stubbornly committing to an alternative strategy that fails to achieve its intended purpose. Even the best chess players can embark on a game plan that doesn't work out.

At a certain point, understanding that a draw is preferable to a loss sets the new best-case scenario. The same happens in options trading. Now and then, a trade does not work out.

For the chess player, altering moves to force a draw limits the player's risk. For the options trader, closing a setup at a small loss also helps mitigate risk. Risk management means reserving capital for the next trade instead of risking a total loss, hoping a trade will turn around and work out.

🧠 Composure

Reserving capital for the next trade isn't just an economically sound move. It is also psychologically sound. Successful options traders know they can't win on every trade.

So do successful chess players. Losing is part of playing the game. The successful players and traders take that in stride. They remain focused and devoid of any negative emotion that can get in the way of performing at the top of their game.

The Difference Between Chess and Options Trading

The alphanumerical grid of a chess board has led to algorithms that make it possible for people to play the game on computers. Software programs even help teach kids to play chess. We have seen chess tournaments pit top-ranked humans against machines. Who knows?

One thing is for sure, while chess players don't currently have to compete with computer algorithms to be successful, human options traders do. The possibility exists that someday in the future, algorithmic trading will dominate the options market.

Even if that happens, I'm convinced that a trader who behaves like a chess player and follows the seven rules above will have ample opportunity for success.

Stay Connected!

Join our mailing list to get notified of all new blog posts, and receive the latest news and updates from our team.